Of Friends and Lucky Tips

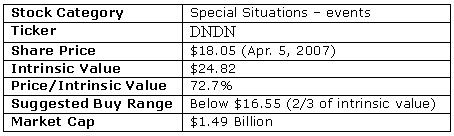

I first heard about Dendreon three weeks ago from a friend at University of Victoria. He is the best special-situations investor that I know of and so naturally when he told me about Dendreon I digged deep into what has now become an amazing story. I came to the conclusion that Dendreon's prostate cancer therapeutic vaccine, Provenge, was very promising and would likely be approved by the FDA.

Boosting Returns with Call Options

On the day before the FDA advisor panel review, I bought some May $12.50 call option as well as some shares. Those May $12.50 call options are now with $7.60, up from $0.40 when I first bought them. 1800% gain in two weeks – not bad at all. The shares of Dendreon returned 246% in the same time period, which is still spectacular but pales in comparison to the power of leverage that the call options provided. So should I sell these options now? Should you sell the stock?

Buy, Sell, or hold Dendreon?

Well, anytime when a stock rises this much in such a short amount of time, investors instinctively want to lock in some gains. However, as a value investor, I never make buy/sell decisions based on how much the stock has gone up or down. A value investor's motto is blindingly simple: buy when a stock is below what it should be worth; sell when a stock is at or above what it should be worth.

In order to know when to sell Dendreon, let's see how a value investor like Warren Buffett might value the company using a discounted cash flow (DCF) analysis.

Will Provenge Get Approved?

Of course, any valuations would only be useful if Provenge gets approved on May 15. So first, let me say this: Provenge will be approved. The following excerpt outlines how the FDA makes decisions on approvals:

At the heart of all FDA's medical product evaluation decisions is a judgment about whether a new product's benefits to users will outweigh its risks. No regulated product is totally risk-free, so these judgments are important. FDA will allow a product to present more of a risk when its potential benefit is great — especially for products used to treat serious, life-threatening conditions. (FDA's official website)

The above statement was one of the key reasons I invested in Dendreon because not only is Provenge safe, it is also a drug that's used to treat a life-threatening disease (end-stage hormone refractory prostate cancer) and I decided that Provenge would be approved even if the advisory panel's votes were split on its efficacy. Now that the panel has voted overwhelmingly in favour of Provenge (17-0 for safety and 13-4 for efficacy), the final approval should not be a mental block in your decisions to invest in Dendreon.

Dendreon's Price Tag: $20, $30, $70?

So let's see how much Dendreon is worth using the discounted cash flow (DCF) analysis. The DCF is a more robust valuation method than merely multiplying the price/sales ratio by the discounted peak sales. The idea of a DCF is to discount each year's free cash flow that a company generates in the future back to today's value and then add them up. Here's an article from Investopedia on using DCF in biotech valuation.

I will be using the sales revenue as estimated by Adam Feuerstein from Thestreet.com as a basis for my calculations. Therefore, my DCF analysis is only as reliable as Adam's sales revenue numbers.

To double-check Adam's numbers, I looked at an interview conducted by the Wall Street Journal with Simon Hall, director of the Deane Prostate Health and Research center at the Mount Sinai School of Medicine in New York, and an investigator on a trial of Provenge. Dr. Hall estimates that there are “between 29,000 to 40,000 men” eligible to use Provenge.

Adam's revenue model No. 1 estimates that there will be 49,823 men eligible for Provenge growing at 1.5% each year for an aging population. This estimate is clearly much higher than Dr. Hall's estimate and so it would be unreliable to perform a DCF analysis based on this model.

Adam's revenue model No. 2 estimates 34,123 men eligible for Provenge. This number falls nicely in the middle of Dr. Hall's estimates.

Adam's revenue model No. 3 estimates 6,885 patients eligible for Provenge in 2007 growing to 27,366 in the year 2012. He then applies a much higher Provenge penetration rate for these patients in comparison to the previous two models. Still, these numbers are much lower than Dr. Hall's estimates – model three is overly conservative.

I am going to use the average sales revenue as derived from the three models (table 1) for my DCF analysis.

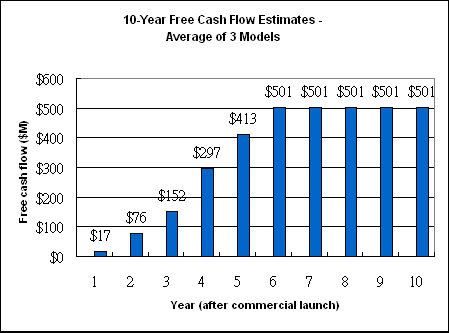

To get the free cash flow I take the above sales revenues and subtract from each one the costs of bringing Provenge to the market. The costs include operating costs (eg. manufacturing, research & development, sales & marketing and administration), taxes, as well as any capital investments in laboratory equipments and facilities.

To estimate the costs, I looked at several biotech companies and took note of their capital expenditure as a percentage of operating cash flow. What I found was a typical range between 20%-40%. However, simply subtracting 20%-40% from the sales revenue would be an overestimation of the free cash flow because Provenge requires a higher cost to produce than the typical drug – Dr. Hall states that Provenge is “custom made for each individual patient with their own cells.” Hence, I am going to subtract 50% from the sales revenue to account for the higher costs.

What I end up with is the 10-year free cash flow available for use at Dendreon's discretion in the figure below.

Figure 1

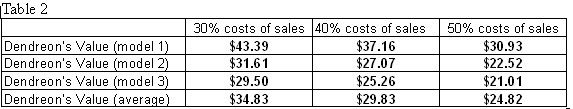

Finally, I discount each year's free cash flow back to the present value and add them up to get a total present value of $2,063,182,242. Subtract long-term debt of $17,027,000 and divide by the total number of shares outstanding gives me a price tag of $24.82 for Dendreon. Remember that this price tag is derived from 50% costs of sales and the average of the three sales revenue models.

Table 2 below shows the rest of the price tags for Dendreon if I had used different costs percentages and sales models.

As a word of caution, when performing a long-term analysis like the DCF, always remember Murphy's Law, which states: anything that can go wrong will go wrong. Frankly speaking, perfect execution is not possible no matter how good a company is. Therefore, when given a range of values or estimates, it's prudent to stick with the lower ones. With that said, the DCF I performed on Dendreon comes with several assumptions:

- The company is only able to generate free cash flow for ten years.

- Provenge is the company's only source of revenue for the next ten years.

- Sales revenue of Provenge only comes from the U.S.

In conclusion, the intrinsic value of Dendreon would be significantly higher if the company exceeds any of the above expectations. Dendreon remains undervalued even after the tripling of its stock price since the FDA panel vote on Mar. 29.

Disclosure: I own shares and call options of Dendreon.

7 comments:

Hi Tweakie,

Very nice work - but just one major correction. Adam's biggest mistake, IMHO, was estimating a $30,000 cost per patient. If you look at other cancer bio-drugs, you'll see that they are priced at the $45-55,000 range. Hence, applying the $45,000 price tag instead of $30,000, under the same operating costs, would DOUBLE the discounted share price.

Just my 2 cents

You also ignored the ROW (sales outside of U.S.) value of Provenge, which I think easily pushes your estimate up another 20% or more.

I cannot agree with you more on both your points. In fact, Dr. Hall has stated that Provenge's price is $20,000 per injection and each patients typically receives three shots! $20,000 x 3 is easily higher than Adam's $30,000 estimate.

And yes, I suspect Dendreon will likely form partnership to sell Provenge in Europe some time in the near future. I'm unsure of the time frame that this will happen as I did not look into whether Provenge will need re-approval by an FDA-equivalent in Europe.

This is a great article on Dendreon, which gets straight to the point. I enjoyed reading an article that quickly discussed the stock in question, and offered a valuation. Great job.

Steve Rubis

http://researchingstocks.blogspot.com

I appreciate your attempted use of DCF here, but I can't find any disclosure of the discount rate you applied. It is extremely critical in valuing such highly risky/variable companies. Without disclosing that, it really isn't possible for the reader to determine how aggressive/conservative your target price is. Garbage in --- garbage out.

The only flaw I see is that you assume that it will have 100% market share. There are other drugs being developed and some people will still use today's standard of care for awhile.

For the discount rate, I always keep it the same for all companies. I like to use the long-term 30 year T-bill yield. But since we're in a low interest rate environment right now, the yield is below the historical average. Hence, I'm using the historical average T-bill yield which is 8% for my discount rate. Out of the numerous DCF I've performed on various companies, I rarely find an 8% discount rate to be too aggressive.

For the inclined readers have a look at Common DCF Errors.

As for the other comment about 100% market share assumption, I can clearly say that is not the case. The market penetration rates are 2%, 10%, 20%, 40%, 50% for each year until peaking at 55%.

Post a Comment