In the past two years, I've learned a great deal about the practice of stock market investing. Below is an investment framework that I've distilled down to from giants such as Warren Buffett, Chuck Royce, John Templeton, Bill Miller, Francis Chou, Peter Cundill and Tom Stanley.

But first, before getting ahead of ourselves, let's make sure we are clear on the definition of an investment. Ben Graham defines it as follows:

Definition

An investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.

Now, here is the chicken soup recipe for the ultimate investor:

Philosophy

- Must thoroughly analyze a company, and the soundness of its underlying businesses

- Must deliberately protect against serious losses

- Must aspire to adequate, not extraordinary, performance

- Be a Long Term Investor

- Have a Flexible Approach

- Actively Look for Ideas

- Only buy the best ideas

- Be Skeptical

- Filter out the noise

- Stay humble

- Invest differently from the crowd (be a contrarian)

- Be fearful when others are greedy. Be greedy when others are fearful.

- Understand the intrinsic value of a business

- Seek valuation discrepancies, not just statistically inexpensive stocks

- Set buy and sell target for all positions

- Always follow where reason leads rather than fall victim to passion and emotions

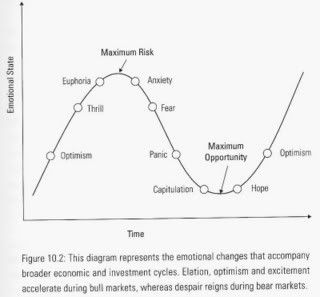

- Always keep the diagram below in mind

... and below are the buy/sell criteria I set for myself when it comes time to make a buy/sell decision:

Buy Criteria

- Odds are stacked up in my favour

- The business is understandable

- The company has good corporate governance (i.e. not run by crooks)

- People are overly pessimistic (i.e. hardly any bullish analyst)

- There is a margin of safety

- Catalysts exist

Sell Criteria

- The original thesis to purchase the stock is wrong

- The stock price has reached my target

- People are overly optimistic

- The portfolio requires rebalancing

- A better opportunity exists elsewhere

Finally, all of my investments fall into one or more of these categories:

Categories

- Cash cow

- Cyclicals: Success here usually involves correctly anticipating when a cyclical industry will rebound, though precision is not necessary as long as the company has a strong enough balance sheet to weather the tough times.

- Distressed industry

- Events-related

- GARP (Growth At a Reasonable Price)

- Great Business on Discount

- High Growth

- M&A (Mergers and Acquisitions)

- Net-net

- Short (use of puts options, not actual short-selling)

- Spinoff

- Turnaround & Restructure

- Workout : Workout investment is one in which a financially strong security is priced below a conservative estimate of a realistic value, and the investor has reason to believe that an asset-conversion event might take place within a given time span. The asset-conversion event could be a merger or an acquisition, the sale of assets, a liquidation, a reorganization, a contest for control or a share-repurchase program.

I hope you will find the above investment recipe useful in your own ventures.

No comments:

Post a Comment